Welcome to Adventures in Workland! This essay series was inspired by a frustrating attempt to condense decades of work experience to one-page, and I realized resumes are flat and lifeless representations of the vivid stories, relationships and lessons that make one a valuable part of the workforce. In this series, I will illuminate the staid bullet points and job descriptions, animating them into the full dimensional glory they deserve. I hope my stories will make you reflect and honor the value of your employment history as well. Algorithms, bots and job board filters have it wrong: You are more than the sum of your job descriptions. Feel free to comment and share your silliest, funniest, most impactful workland adventures with the world.

Not all, but some of my best lessons in sales come from my time in the mortgage industry. It is the biggest chunk of my career, and the learning curve was deep as the industry changed drastically from my first day until I finally closed shop. When I hired in, I had no true knowledge of mortgages, although I bought my first home the year prior. I understood how integral a lender can be, especially for a first-time homebuyer. I always remembered my loan officer’s patience with me when I began working with new clients.

I began at the bottom, hired as a loan processor and office assistant. This was on the cusp of the first refinance boom. Mortgage software was just being implemented, streamlining the application and underwriting process. When I bought my home, I completed my entire application by hand, the new programs made it possible to handle an application by phone in 15-20 minutes and just meet the client for signatures. We were a small office, an offshoot of a large real estate company. We were expected to be an on call and easily accessible in-house mortgage company. I worked directly for the manager/operator, and there was another loan officer stationed at the realtor office across town. Her files were sent to me by courier to process. This was before Edocs and attachments. Faxes were the height of technology, and not an Efax, but paper faxes. The ones that made noise. As I began training, the phone rang incessantly. My manager assured me this was unusual. Little did we know the refinance market was about to explode. My first week we worked side by side at the computer, learning to navigate the software, with time to learn and understand every document and industry acronym. Soon we were so busy, my training morphed into trial by fire. He mouthed instructions while executing an endless succession of phone applications. It would not have come up in the interview, but I can’t read lips, so there were laughs aplenty at my expense. I appreciated his patience, he appreciated my willingness to jump in anywhere he needed. We worked long days to keep up with the demand. I assured his parents he was eating when they called (I came to know his whole clan) and I refilled that coffee cup all day as he moved from application to application. He was a great teacher and a really great guy. He’s one of my favorite bosses.

We continued to grow. Another processer came on board, and I trained her to manage the other loan officer’s files. Then we added more loan officers, and my trainee and I became a processing factory. As my circle of friends asked for first time homebuyer advice, I turned the leads over to my boss. Since I was handling his files anyway, he allowed me to front the deals from application to close. He offered me a small cut of the commission for doing his work and bringing in the business. I was earning a salary as a processor and getting a nice incentive as a pseudo loan officer. The next year, my beloved manager left the company. The new management required me to make a choice-be salaried as a processor or full commission as a loan officer, I could not do both. I couldn’t imagine being full commission. I was only a few years out of college, and we never covered this scenario in any class. Handling a few loans that fell into my lap for extra cash is great, but prospecting and meeting quotas to sustain myself? There was no draw, no base, it was eat what you kill. I wasn’t sure if I was a killer.

I discussed the options with my father who encouraged me to take the leap. A sales career, he assured me, was a great opportunity and he promised that he would have my back. He also gave me a template to manage my finances that anyone living on commission should know. If you want to know what he told me, reach out via my contact info and I will be happy to share. With my dad’s confidence guiding me, I took the jump to full time loan officer.

A real estate agent sent me a referral for a small investment purchase. This was the era when investment properties were becoming easier for laypeople to attain. Interest rates were low, the underwriting guidelines were lax and there were late night informercials of how to buy and leverage investment properties for financial success. The client was pleasant and easy to work with. She was a first-time investor, a single woman building a portfolio. In Lansing, Michigan, the average home price was $64,000. Her property was much less than that, so my commission was not substantial. I wasn’t ecstatic but I didn’t mind: my former manager taught me that all money spends the same, so big or small, just add it to the stack. In addition, as inexperienced as she was, she didn't mind (or perhaps notice) how green I was.

A few days after the close, I received a call. She had bought the property from an older lady, who moved to live with family. Per the contract, the property should have been emptied at close, but she discovered the garage full of 30 years of the seller’s possessions and memories. She initially called the realtor, but he blew her off, telling her he refused to pester a little old lady about fulfilling her side of the contract. I let her know that this wasn’t really in my wheelhouse but please allow me to make some calls and see what could be done for her. I may have been green, but I did know the finance people don’t deal with contract issues like this. This was the quintessential ‘not my job’ moment, but...

First, I called the agent, and he confirmed what she said. He told me the deal wasn’t worth the trouble of trying to hold the seller to her contractual obligation. After I pondered his audacity, I called the realtor’s closing office, explaining the situation and asking for advice. They jumped to action and arranged to empty the garage at their expense. Easy, peasy. My client called me, ecstatic. She thanked me profusely but was very clear that she would NEVER work with that realtor EVER again. She realized her little deal wouldn’t make anyone rich, but she didn’t deserve to be brushed aside so quickly. I tried to assuage her ire at the agent, but the damage was done. She couldn’t thank me enough for my help and I ended the call wiping my brow, but not expecting much beyond that conversation.

What happened next is the lesson. I didn’t know but my client's father was the pastor of one of the largest churches in the city. She knew everyone and everyone knew her. She worked for the State of Michigan and had wide influence. Of course, I had no way of knowing her stature in the community, this was pre-social media, we weren't Googling. Soon, I would receive at least 4 calls a month from people she referred. Not only did she give my name to everyone she knew looking to buy or refinance, but she returned to me again and again. She bought more investment properties, each one more expensive than the last. She bought a personal residence, which was far beyond the average sales price. Her parents refinanced their home with me and then referred me to their friends and associates. I was a part of their collective real estate transactions for years. Her referrals then referred their friends and family to me. I might have been the preferred lending vendor of State of Michigan employees. If I could illustrate it, it would have looked like a Ponzi, with level after level or tiered referrals. I could trace 40% of my annual business back to this one person. How much money did that realtor leave on the table from one dismissed phone call? I was the beneficiary of a career’s worth of positive brand recognition for just making the effort to help a client after the sale.

As a salesperson, can you imagine the power of 40% of your business coming from not just warm, but enthusiastically hot, leads?

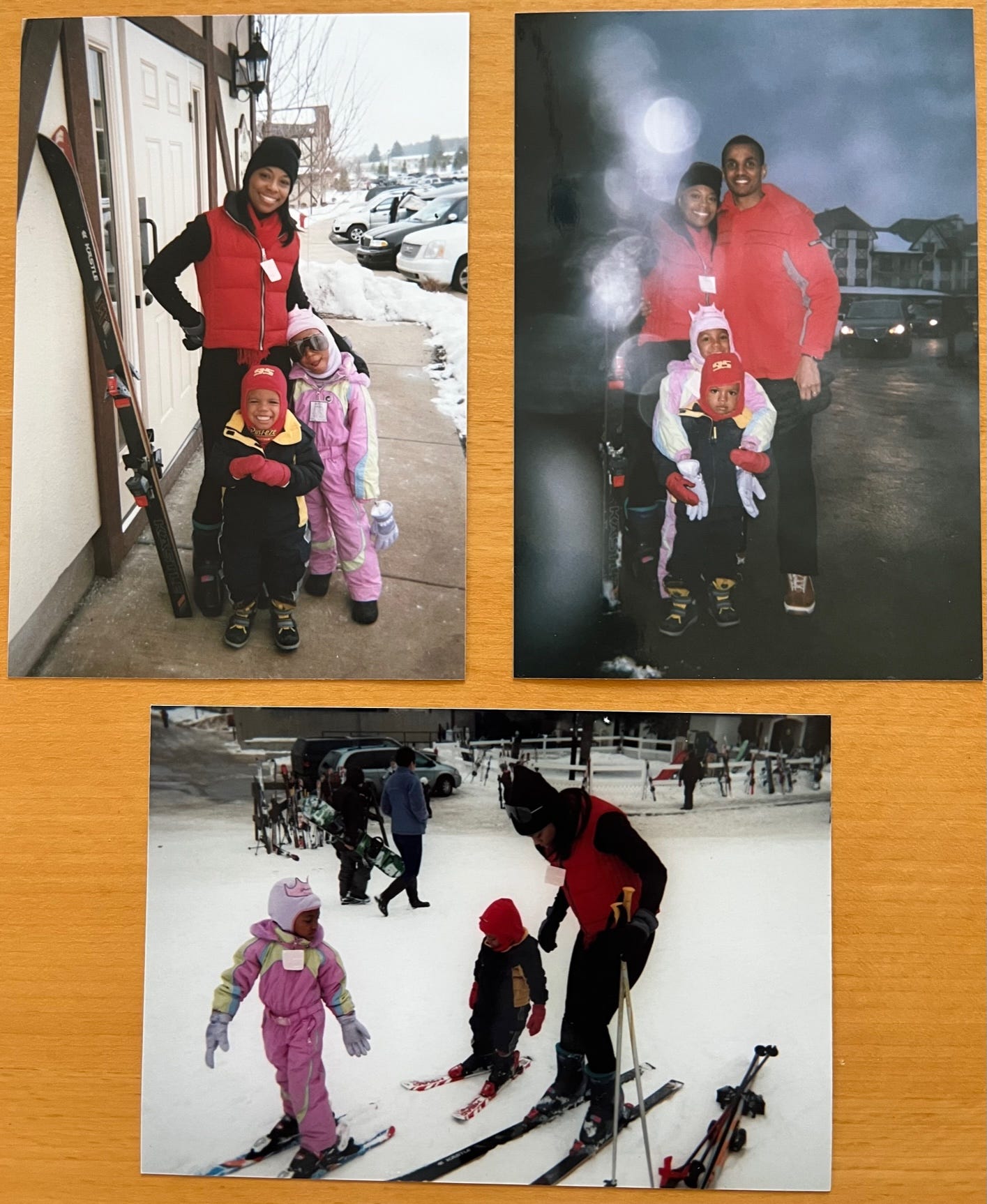

In addition to the professional profits were the treasured relationships I built with my clients. I benefited in many ways: I bought my first luxury automobile from one client at a ridiculous price. He made sure everything on the car was in tiptop shape to thank me because of the cost savings our deal put on his balance sheet. He also knew I was single with NO automotive savvy. I helped another referral with a home refinance following her divorce. Her kids were elementary school aged, but we did so many transactions over the years we joked that I would attend her children’s graduations and when people asked if I was a relative, she would respond “No, she’s the loan officer, but she’s been in the family forever”. She even referred me to her ex-husband. We were just one big happy financial family. When that original client adopted her two foster children, I was honored to offer a character letter. We even vacationed together, my family spending a weekend skiing with her girls at their timeshare. I was single, got married and had kids in the span of our business relationship. A career in sales allows you to become entwined in people’s lives in the best way. I became a financial sounding board for many, calling to ask how moves might impact credit, or wanting a financial opinion on the next step for a specific end goal in mind. The work was fulfilling. Garnering trust and making an impact for others is a good day’s work.

I learned many lessons from my time in real estate that I will dole out in this essay series. As the industry changed, I saw some bad business during my tenure in mortgages. Don't forget it was faulty mortgage transactions that gave us the Great Recession, but I walked away from the industry with no hand in that foolishness. My portfolio of loans was good, and I worked to respect the lesson of the small transaction that built my business.

Always do the right thing.

Be honest about what you don’t know but do your best to find a solution.

Treat all transactions with respect, small or big.

What's done after the sale is just as important as the sale.

When my father encouraged me to take a chance on myself in sales, he advised me “Just do good business and you’ll get good business back. You can never go wrong treating people right.” It sounds simple, but that is a loaded statement. Darn it, if dads aren't always right. My dad did have my back.